Bearish scenario: Sales below 80.00 with TP1: 79.60... Anticipated bullish scenario: Intraday purchases above 80.70 with TP: 81.50...

2024-03-27 • Updated

Crude oil futures surged on Monday due to disruptions in Russian refining capacity caused by Ukrainian drone strikes and Moscow's decision to cut output to comply with OPEC+ targets. The West Texas Intermediate (WTI) contract for May settled at $81.95 a barrel, up $1.32, while the Brent contract for May settled at $86.57 a barrel, also up $1.32. Russia instructed companies to reduce oil production to fulfill its OPEC+ commitments, with voluntary cuts totaling 2.2 million barrels per day. A Ukrainian drone attack caused a fire at the Kuibyshev oil refinery in Samara, knocking out a major refining unit. According to British intelligence, Ukrainian strikes against Russian energy infrastructure have disrupted at least 10% of Russia's refining capacity, potentially leading to time-consuming and costly repairs.

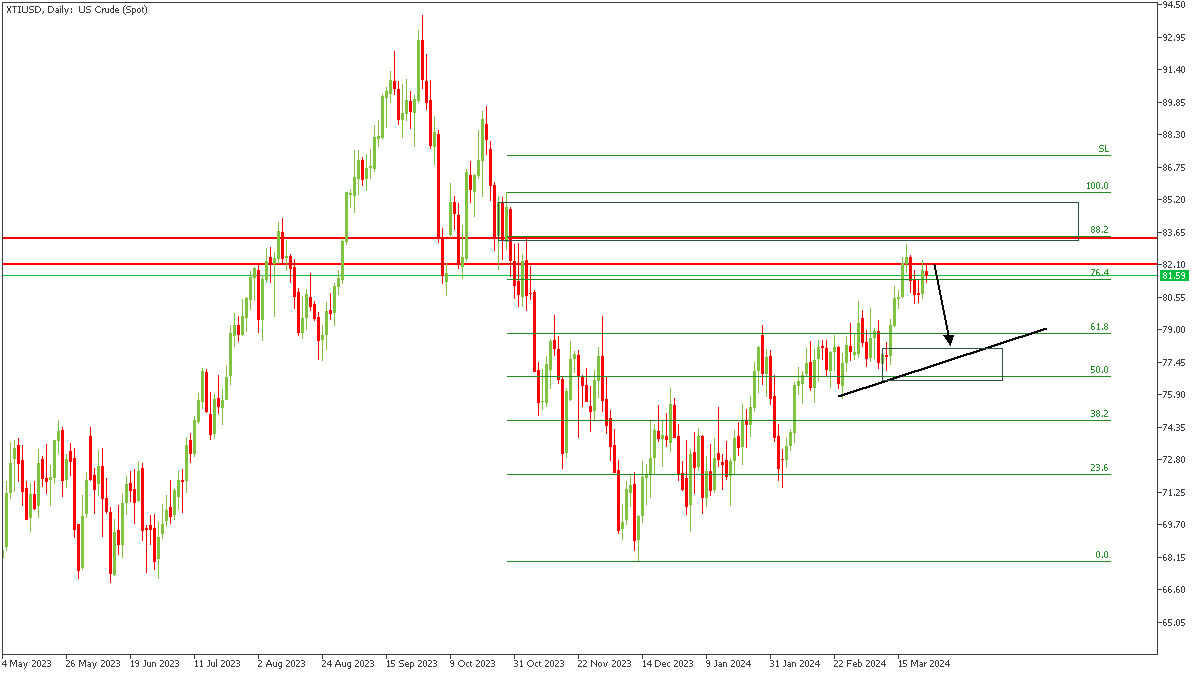

XTIUSD has made an initial reaction off the pivot zone on the daily timeframe, and may slide even further down. This sentiment is based off of the QMR pattern that I have spotted on the 1-hour timeframe, and the 88% Fibonacci retracement level. The primary target here could very well be the trendline support as shown on the chart.

Analyst’s Expectations:

Direction: Bearish

Target: $78.42

Invalidation: $83.53

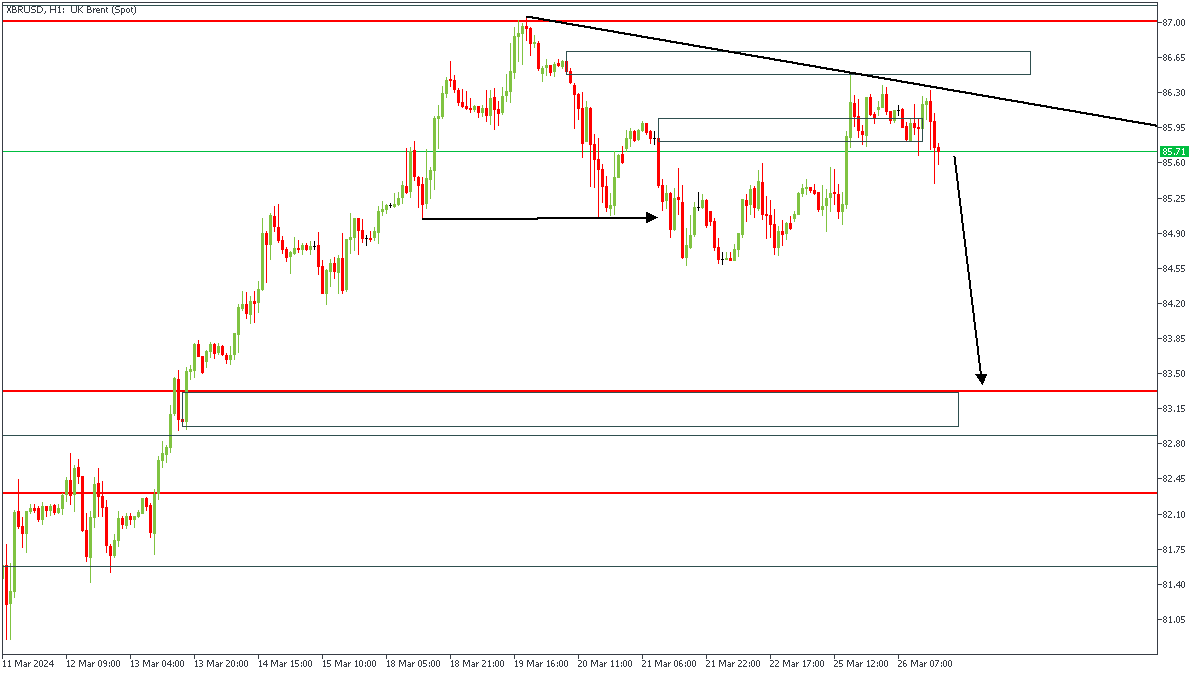

XBRUSD made a sharp reversal after hitting the pivot zone on the daily timeframe. Following this, price retested a trendline resistance after breaking below the previous lows, indicating the likely onset of a bearish trend. It is my belief that price would try to close below the most recent low, since failure to do so would imply a change in market sentiment. My final target, however, is the demand zone marked out towards the bottom of the chart.

Analyst’s Expectations:

Direction: Bearish

Target: $83.36

Invalidation: $86.73

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

Bearish scenario: Sales below 80.00 with TP1: 79.60... Anticipated bullish scenario: Intraday purchases above 80.70 with TP: 81.50...

Brent oil is currently on a bullish trend, facing resistance near $84 and supported by the 200-day EMA. Breaking above this level could lead to a climb towards $90. Short-term support is observed around $80, backed by the 50-day EMA. As summer approaches and travel increases, crude oil tends to benefit from seasonal patterns. Despite temporary setbacks, buying...

Bearish Scenario: Sales below 78.99 with TP1: 77.93, TP2: 77.45, and upon its breakout TP3: 76.56 and TP4: 75.70 Bullish Scenario: Purchases above 78.00 (wait for a pullback to this area) with TP1: 1679.00 (uncovered POC*), TP2: 79.33, and TP3: 79.66 intraday

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!